Money

Overview

- Identify and estimate the various types of costs involved in starting a new venture

- Identify and estimate the various types of revenue applicable to your business venture

- Identify the right pricing model for your venture

- Re-estimate the price for your offering

- Use the estimated costs, revenues, and pricing to determine if your business will be viable/profitable

- Understand the concept of bootstrapping and how to run a lean business

- List out the sources and uses of funds raised through bootstrapping

- Pitch your Basic Financial Plan and the updated Lean Canvas to your class

Session 1: Costs (CORE) - 3 Item[s]

Know all your costs before you start your business.

Costs

-

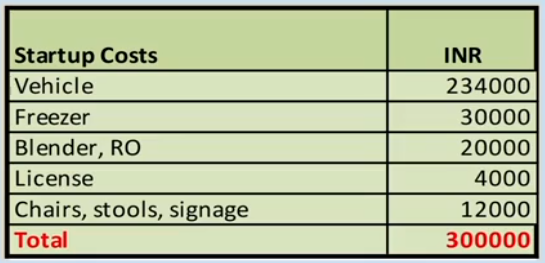

Startup Costs: Cost that an enterprise incurs BEFORE starting a business.

Eg: For a smoothy business:

-

Fixed Costs: Costs incurred on a regular basis irrespective of the production or sales.

Eg:

-

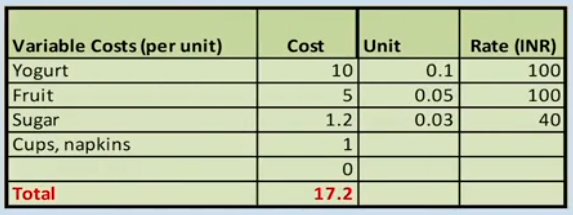

Variable Costs: Costs that depend on the number of units produced and sold.

Eg:

Preference for startup:

Variable costs » Fixed costs » Startup costs

LEASE or RENT vs. BUY

- If you need a freezer, consider renting a freezer, or buy a second hand one.

- If you need manufacturing equipments, consider leasing it over buying it.

Ask questions:

- What is the major costs of the business?

- Can some costs be postponed for a later date?

- Is your business value driven or cost driven?

- Low value price proposition = Cost driven

- Premium product = Value driven

! [[ 31226780_1609401937.pdf ]]

Basic Financial Plan Template: ! [[ Found-ENG-L6-Basic_Financial_Plan_Template_with Explanation.xlsx ]]

Read More: Break-Even Analysis 101: How to Calculate BEP and Apply It to Your Business

BAHASA: Basic Financial Plan Template ! [[ BASIC-BAHASA-L6-STUHANDOUT-Basic Financial Plan Template-Final.xlsx ]]

Session 2: Revenues and Pricing (CORE) - 4 Item[s]

Right price => Customers + Profit

Profit = Revenue - (Fixed + Varriable) Costs

- Understand your customer segment

- Different customer segments have different maximum amounts that they are williing to pay for the product/service.

-

Your price must be below the customer’s highest willingness to pay.

-

Pricing strategy:

-

Maximization: Process by which a company determines the PRICE and PRODUCT output level that generates the most PROFIT.

- This works great when all customer segments have similar willingness to pay AND when the optimal short-term and long-term prices are equal.

- Starbucks: It’s most popular coffees are priced at a premium to maximize profit per cup.

-

Market penetration: Pricing the product at a LOW PRICE to win dominant market share.

- Slack:

- Free basic plan

- Low-priced annual subscription for premium product

- Slack:

-

Maximization: Process by which a company determines the PRICE and PRODUCT output level that generates the most PROFIT.

-

Market skimming: PROFIT MAXIMIZATION STRATEGY for high tech and low availability goods.

- Start with HIGH PRICE, broaden customer base with LOW PRICE.

- Apple:

- Sells latest models very costly.

- Sells old models at cheaper rates.

Tips:

- Price a product higher to start with; then lower it with discounts and offers.

- The other way around usually fails. You will have to add features before increasing price.

- Set the right price to match the perceived value of your product or service.

- Build a fair margin for you.

- Do your research early with real customers.

- Determine customers’ “Willingness to Pay” for your product.

Revenue Stream: Each source of revenue

- Each revenue should be clearly defined.

- Sources

- Pricing

- Life-cycle

- Build dependable revenue streams where you can tap into the same customer for repeat revenue. Eg: Selling smoothy at railway station vs. outside offices

- Be FLEXIBLE with your revenue streams.

- Forcast. Change revenue model if not working.

Ask questions:

- What value are your customers really willing to pay?

- How much does each revenue stream contribute to overall revenue?

! [[ 12916489_1578376046.pdf ]]

! [[ 12916491_1578375984.pdf ]]

Types of Revenues:

- Asset Sale

- Usage Fee

Session 3: Profitability Checks (CORE)

! [[ 31226994_1609402186.pdf ]]

Session 4: Bootstrapping and Initial Financing (CORE) - 4 Item[s]

Bootstrapping

Bootstrap Finance: It is the best and inexpensive method to raise capital.

-

Personal finances: Keeping some money aside for emergencies

- Saving a/c

- Equity in real estate

- Retirement a/c

- Vehicles

- Recreational equipments

- Collections

- Sell some assets or use them as collateral for loans.

-

Loans from friends and family:

- Ask for a specific amount for a designated milestone.

- Formal agreement with detailed payback period

- Tie repayments to revenue growth of the startup

- Communicate the plan and risk upfront

- Ask for a specific amount for a designated milestone.

-

Trade credit:

- Build relationships with suplliers

- Ask for extended due dates

- Cash-advances/Upfont-payments from customers

-

Revenue/Profit:

-

Other ways:

- Subletting of space

- Renting out your machinery or equipments

- Hire freelancers/part-timers

- Cut personal expenses. Do the job which you can do instead of outsourcing.

Key strategies to use funds:

- Convert fixed costs to variable costs

- Lease furnitute and equipments

- Buy used equipment

- Rent vehicles for delivery

- Use your negotiation skills

! [[ 12916503_1578376247.pdf ]]

! [[ 12916508_1578376293.pdf ]]

! [[ 24432847_1592466211.pdf ]]

Additional Videos - 2 Item[s]

Interview1: How Did I Bootstrap My Company and Get My Initial Funding? - Co-founder & CEO, Headout

How did it go?

- Spend our savings (3 co-founders)

- Created a working product (PoC)

- Applied to accelerators

- Good for first time founders in a different country

- Got selected in 500 startups

- Provided networks/connections/brand

How to cut expense

- Lived in a small apartment filled with cockroaches

- Didn’t buy pillows

- Had quota to spend on food, etc.

Initial funding to VC

- Took our money

- Moved to US and build a product

- Kept burn rate very low

- Enough time to get the code ready, up and running

- Got first traction of suppliers and customers

We felt we know enough to approach accelerators, but not VCs (For seed round - A few million dollars)

- Applied to multiple Accelerators

- Got selected in two

- Met many good folks

- Got confidence to move from NYC to SanFransisco

- 4-month phenominal journey

- From negligible traction to fastest growing company in the batch

- Help from ecosystem.

- Got deadlines of 4-month, focussed.

- Worked rediculous hours (due to timezones)

- Rescaled and changed multiple things

- Raised money from VC

- Twice ($2M + $10M)

- Scaled to multiple continents

- Got market fit after $2M

Interview2: Best Practices for Pitching to Investors - Co-founder & CEO, Headout

Groundwork before pitching:

- Set house in order

- Figure out narrative of what are you trying to build

- What about is necessary right now

- How will this make the world a slightly better place than today

- How will this become really big successful enterprise

- Sustainable long-term network effects that will make company defensible from competition

-

Created and practiced mulitiple pitches - 1 minute, 10 minute, with pitchdeck, etc.

-

Created list of FAQs

- Dataroom with all matrices into one

- Detailed financial docs

- Existing numbers

- Projections of future

Getting shortlisted:

- Looked up online cruchbase, angelist, etc.

- Looked the porfolios of VCs and found whose thesis connects with us well (200 names).

- Snippets of things they said in interviews

- Looked at founders who they had invested in, Connect with them.

- Looked for angel investors

- To get help for next phases as well.

- Network effect, Marketplace experience

- Okay with global businesses

Best practices for pitches:

- First pitched to investors who were likely to say NO

- Iterated our pitch

- Have a start and end date, Be organised and execution focussed

- Have all the financial documents ready

- Made a list of investors to pitch to

- Pitched 30 investors in first week

- Went to investors who were most likely going to say YES in second week

- We focussed on investors who were connectors, i.e. had connections with VCs, knew ecosystem

- Met 3-4 angel investors who said YES to investing in us

- They were excited to introduce to their connections

- We made 4 to 25 friends/connections => They wanted to invest in us

- Instead of chasing for meetings, now people were chasing us for meetings.